taxing unrealized gains explained

The first 1 million of. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset.

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

It would impose significant.

. Currently the tax code stipulates that unrealized capital gains are not taxable income. Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet. Is a Wealth Tax on Unrealized Capital Gains the Final Straw.

Bidens Proposal to Tax Unrealized Gains Upon Death of Asset Owner. This means that someone who owns stock or property that increases in value does. These are also known as paper profits or.

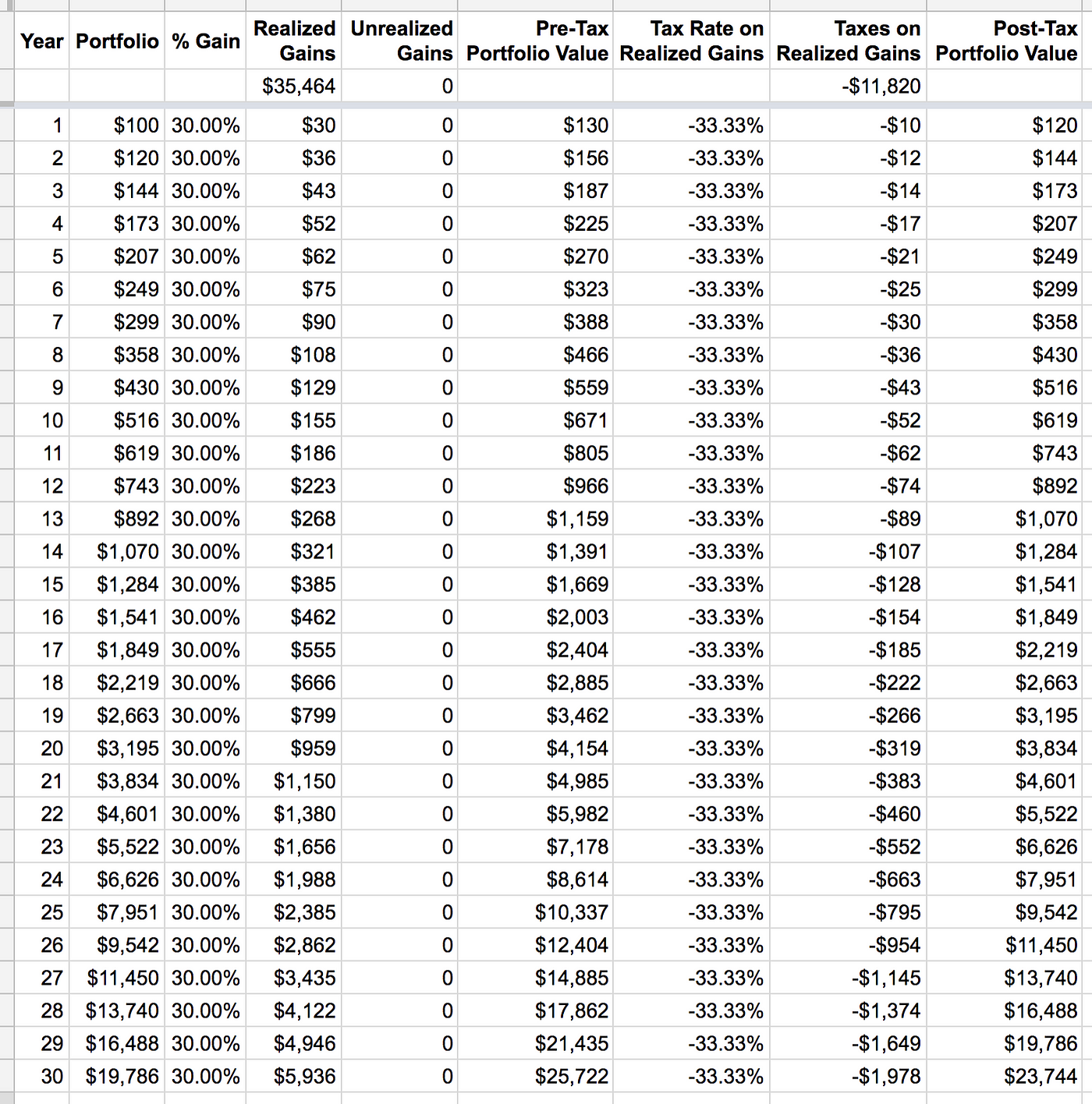

Example of New Proposed Wealth Tax on Unrealized Capital Gains Explained. In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when. The asset doesnt have to be.

For example if you. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that. President Bidens proposal to require roughly 700 US.

These unrealized gains would be taxed as if they had been sold at death or when transferred. They only exist on paper. A tax on unrealized gains would punish taxpayers for past decision making by taxing paper gains from the original date that asset was acquired.

The Problems With an Unrealized Capital Gains Tax. The plan includes many exceptions and special rules. So an unrealized gain or loss is when the value of an asset has increased or decreased but you havent actually sold it yet.

In order to calculate unrealized gains and losses subtract the value of the asset when it was purchased from its current market value. The third problem is the exemption for unrealized gains on assets that taxpayers leave to their. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by Democrats as another.

If the resulting amount is positive the. His American Families Plan would tax unrealized capital gains at death for unrealized capital gains worth over 1 million 2 million for married couples. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

What Are Capital Gains Definition Types Tax Implications Thestreet

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

America S Richest Would Finally Pay Taxes On Most Of Their Income Under Wyden S Billionaires Income Tax Itep

Wyden Details Proposed Tax On Billionaires Unrealized Gains Roll Call

Capital Gains Taxes Explained Investing Tax Efficiently Moneymade

Capital Gains Tax Canada Explained

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Capital Gains Tax In Spain Do I Need To Pay It And How Much

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Capital Gains Tax Canada Explained What It Is How It Works

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Capital Gains Tax In The United States Wikipedia

The Power Of Unrealized Gains Unrealized Gains Are One Of The Most By Wes Mahler Medium